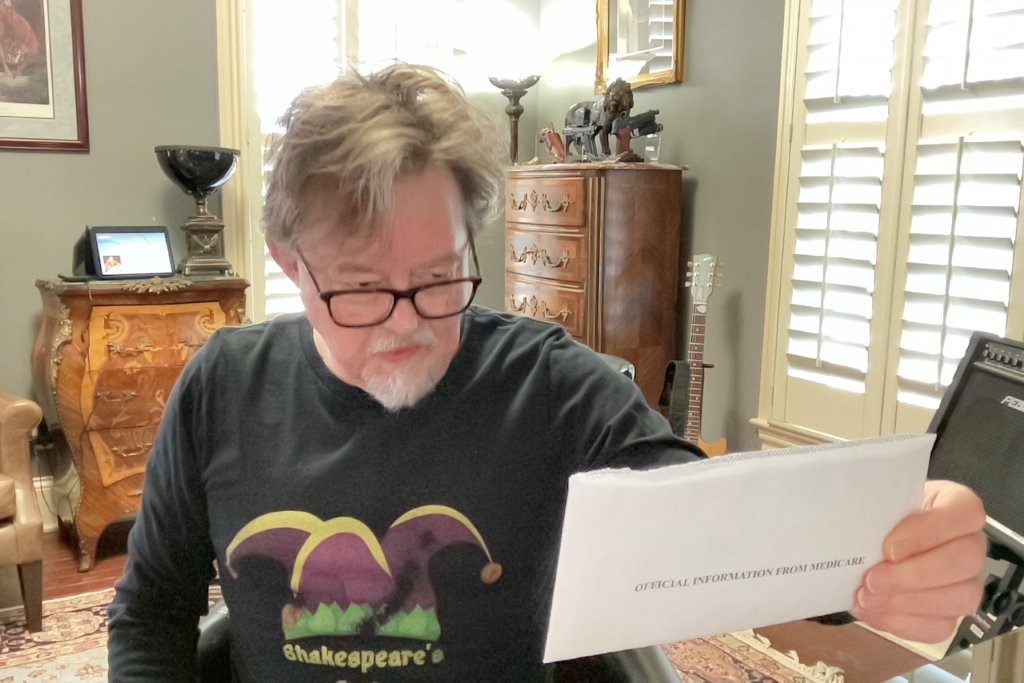

Growing Old

Medicare

Turning 65 is a significant milestone in many people’s lives, and one of the most important transitions associated with this age is becoming eligible for Medicare. Medicare is the federal health insurance program designed primarily for individuals aged 65 and older, although it also provides coverage for certain younger people with disabilities and individuals with specific medical conditions like end-stage renal disease or amyotrophic lateral sclerosis (ALS). For those approaching this age, understanding Medicare’s structure, benefits, and enrollment processes is crucial for ensuring access to affordable healthcare during retirement.

The program is divided into four main parts: Part A, Part B, Part C, and Part D, each serving a specific purpose in covering healthcare needs:

- Medicare Part A: Known as hospital insurance, Part A covers inpatient care in hospitals, skilled nursing facility care, hospice care, and some home health services. Most people do not pay a premium for Part A because they have paid Medicare taxes during their working years.

- Medicare Part B: Often referred to as medical insurance, Part B covers outpatient care, doctor’s visits, preventive services, and medical supplies. Unlike Part A, Part B requires a monthly premium, which is based on income.

- Medicare Part C (Medicare Advantage): This is an alternative to traditional Medicare that allows beneficiaries to receive their Part A and Part B benefits through private insurance companies approved by Medicare. Many Medicare Advantage plans also include prescription drug coverage and additional benefits such as vision, dental, and hearing services.

- Medicare Part D: This part covers prescription drugs. Offered through private insurers, Part D plans help reduce the cost of medications and include a range of options to suit individual needs.

What Is Medicare?

Medicare was established in 1965 as part of the Social Security Act, providing a safety net for older Americans who might otherwise struggle to afford medical care. It is funded through a combination of payroll taxes, premiums paid by beneficiaries, and general federal revenue. While Medicare offers comprehensive coverage for a range of medical services, it’s important to note that it does not cover everything. Many beneficiaries choose to supplement their Medicare coverage with additional plans to address gaps.

Eligibility and Enrollment

For most people, eligibility for Medicare begins at age 65. If you’re already receiving Social Security or Railroad Retirement Board (RRB) benefits before turning 65, you’ll be automatically enrolled in Medicare Parts A and B. However, if you’re not yet receiving these benefits, you’ll need to apply for Medicare during your Initial Enrollment Period (IEP).